September 18, 2025

Monsoon Season Disruptions: Building Resilient Food Distribution Networks for UAE’s Peak Trading Periods

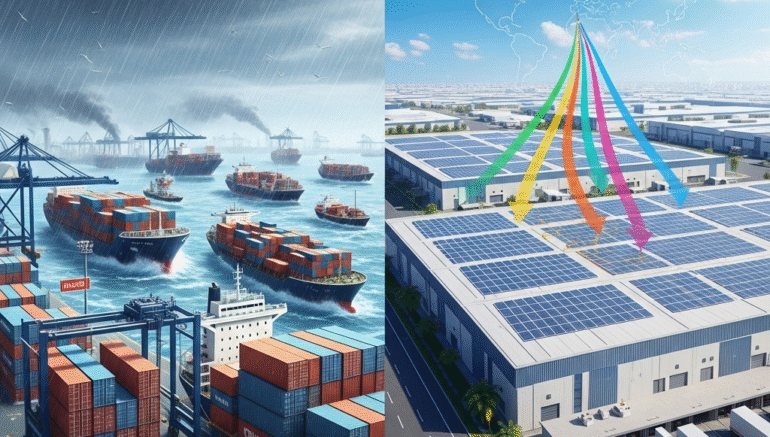

As the monsoon season sweeps across South Asia and the Indian Ocean, its ripple effects reach far beyond the immediate rainfall zones, significantly impacting the UAE’s food distribution networks during critical trading periods. With over 85% of the Emirates’ food supply imported through maritime routes, disruptions from monsoon-related port congestion, flight delays, and supply chain bottlenecks can cascade into inventory shortages, delivery delays, and elevated costs precisely when demand peaks.

Building resilient food distribution networks capable of weathering these seasonal challenges has become essential for maintaining service continuity, protecting margins, and ensuring food security across the UAE’s diverse market segments.

Understanding Monsoon-Related Supply Chain Vulnerabilities

The Southwest Monsoon (June-September) and Northeast Monsoon (October-December) create systematic disruptions across key supply corridors feeding the UAE market. These seasonal weather patterns affect multiple critical touchpoints:

Port Operations and Maritime Logistics

Major shipping routes from India, Pakistan, and Southeast Asia—responsible for delivering rice, spices, dairy products, and fresh produce to UAE ports—experience significant delays during monsoon periods. Port congestion at Mumbai, Karachi, and Colombo can extend vessel dwell times by 3-7 days, while rough seas force cargo ships to reduce speeds or seek alternative routes.

Jebel Ali Port, despite its advanced infrastructure, faces capacity constraints when multiple delayed vessels arrive simultaneously, creating bottlenecks that ripple through the entire distribution network. Container discharge delays of 24-48 hours become common, while temperature-sensitive cargo faces elevated spoilage risks during extended port stays.

Air Freight Limitations

Monsoon-induced flight cancellations and delays particularly impact high-value, time-sensitive shipments such as exotic fruits, premium dairy, and specialized organic products. Dubai International Airport and Al Maktoum International experience reduced cargo capacity when passenger flights are cancelled, forcing freight consolidation and priority reassessment.

Air freight rates typically surge 15-25% during monsoon periods as available capacity shrinks, creating cost pressures for distributors committed to maintaining inventory levels for peak trading seasons.

Regional Road and Rail Networks

Overland routes through Pakistan and Iran—increasingly important for cost-effective bulk commodity imports—face disruptions from flooding, landslides, and infrastructure damage. The UAE’s strategic land corridors for wheat, sugar, and cooking oils can experience delays of 5-10 days during severe monsoon events.

Peak Trading Period Vulnerabilities

Monsoon season disruptions become particularly problematic as they coincide with several peak trading periods throughout the UAE calendar:

Ramadan and Eid Preparations

The holy month of Ramadan drives massive demand spikes for dates, dairy products, meat, and traditional sweets. When monsoon delays affect shipments from key supplier countries like India and Pakistan—major sources of Ramadan essentials—distributors face inventory shortfalls during their highest-revenue period.

Pre-Ramadan stockpiling becomes complicated when monsoon forecasts predict extended delays, forcing distributors to balance carrying costs against stockout risks. Companies that fail to build adequate buffer stocks during pre-monsoon periods often struggle to meet HORECA demand during the final weeks of Sha’ban.

Summer Peak Season

Dubai’s summer months (June-August) overlap directly with Southwest Monsoon intensity, creating a perfect storm of elevated demand and supply disruptions. Hotels, restaurants, and catering companies require consistent inventory to serve peak tourist seasons, while monsoon delays threaten service continuity.

Beverage distributors face particular challenges as demand for soft drinks, juices, and bottled water surges precisely when shipping delays from major suppliers become most severe.

Back-to-School and Corporate Catering

September marks the return of corporate dining and school meal programs following summer holidays, generating substantial B2B demand. However, this timing coincides with late monsoon disruptions and the transition to Northeast Monsoon patterns, extending supply chain uncertainty into Q4.

Building Monsoon-Resilient Distribution Networks

Diversified Sourcing Strategies

Multi-country supplier portfolios represent the first line of defense against monsoon disruptions. Rather than concentrating sourcing from monsoon-affected regions, resilient distributors establish parallel supply channels from alternative geographies:

-

- European Alternatives: Dairy products from Netherlands and Germany provide monsoon-immune alternatives to Pakistani and Indian suppliers

-

- Australian and New Zealand Routes: Premium beef and lamb sourcing bypasses Asian monsoon zones entirely

-

- North African Corridors: Egyptian and Moroccan suppliers offer alternative sources for citrus fruits and vegetables

Source International exemplifies this approach through its globally diversified supplier network, maintaining active relationships across five continents to ensure supply continuity regardless of regional weather disruptions.

Strategic Inventory Management

Dynamic safety stock models adjust buffer levels based on monsoon forecasting and historical disruption patterns. Advanced distributors employ weather-intelligence platforms to predict supply risks 4-6 weeks in advance, enabling proactive inventory adjustments.

Key strategies include:

-

- Pre-Monsoon Stockpiling: Building 4-6 weeks of additional inventory for critical SKUs before June monsoon onset

-

- Seasonal SKU Prioritization: Focusing buffer stocks on high-velocity, low-substitution products most vulnerable to delays

- Flexible Storage Partnerships: Securing surge capacity through temporary warehouse agreements during pre-monsoon stockpiling periods

Hub-and-Spoke Resilience Architecture

Geographically distributed storage reduces single-point-of-failure risks inherent in centralized distribution models. Resilient networks establish primary hubs in multiple emirates, enabling continued operations even when specific ports or routes face severe disruptions.

Source International’s hub-and-spoke architecture includes primary storage in Jebel Ali Free Zone, secondary facilities in Abu Dhabi and Sharjah, and micro-fulfillment centers across Dubai’s key commercial districts, ensuring service continuity regardless of localized disruptions.

Technology-Enabled Monsoon Preparedness

Predictive Analytics and Weather Intelligence

AI-powered forecasting platforms analyze monsoon patterns, shipping schedules, and demand forecasts to identify potential disruption scenarios weeks in advance. Machine learning algorithms process historical weather data, port performance metrics, and supplier reliability scores to generate actionable risk assessments.

Advanced distributors integrate weather APIs with their warehouse management systems, automatically triggering inventory adjustments when monsoon intensity forecasts exceed predetermined thresholds.

Real-Time Shipment Tracking

End-to-end visibility platforms monitor vessel positions, port congestion levels, and estimated arrival times across all active supply routes. IoT sensors on shipping containers provide continuous temperature monitoring, enabling proactive quality management during extended transit periods.

Digital tracking dashboards alert distribution teams to developing delays 48-72 hours before scheduled arrivals, providing time to communicate with customers and adjust delivery schedules proactively.

Dynamic Route Optimization

Adaptive logistics software automatically recalculates optimal shipping routes as monsoon conditions evolve. When primary ports experience congestion, the system evaluates alternative discharge points, inland transportation options, and total delivered costs to recommend route modifications.

This technology proved particularly valuable during the 2024 monsoon season when severe flooding at Mumbai Port forced urgent rerouting through Mundra and JNPT, adding 3-4 days to standard transit times.

Financial Risk Management and Monsoon Planning

Insurance and Risk Transfer

Comprehensive cargo insurance covering monsoon-related delays, spoilage, and trans-shipment costs protects distributors from financial losses during severe weather events. Advanced policies include business interruption coverage for extended supply disruptions exceeding 7-10 days.

Forward-contract purchasing enables distributors to lock in commodity prices and supplier commitments before monsoon season, reducing exposure to spot-market volatility during supply shortages.

Customer Communication and Expectation Management

Transparent communication protocols keep HORECA and retail customers informed about potential delays and mitigation measures. Proactive notifications via customer portals and mobile apps help partners adjust their own inventory and menu planning to accommodate temporary availability constraints.

Service level agreements incorporate monsoon clauses that define modified delivery windows and quality standards during severe weather periods, protecting distributor relationships while acknowledging external disruption factors.

Collaborative Industry Approaches

Port Authority Partnerships

Leading distributors maintain direct relationships with port authorities at Jebel Ali, Khalifa Port, and regional discharge points to receive priority handling during congestion periods. These partnerships often include dedicated berth allocation and expedited customs clearance for pre-registered shipments.

Freight Consolidation Networks

Collaborative shipping arrangements with other importers optimize vessel utilization and reduce per-unit freight costs during monsoon delays. Shared container programs enable smaller distributors to access the same route diversification strategies employed by larger operators.

Success Metrics and Continuous Improvement

Resilient distribution networks establish monsoon performance KPIs to measure preparedness and identify improvement opportunities:

-

- Fill Rate Maintenance: Target 95%+ availability for critical SKUs throughout monsoon periods

-

- Delay Mitigation: Minimize customer delivery delays to <48 hours despite supply chain disruptions

-

- Cost Control: Limit monsoon-related expense increases to <3% of total logistics costs

-

- Quality Preservation: Maintain temperature integrity and product quality standards for 98%+ of shipments

Annual post-monsoon reviews analyze performance against these metrics, informing enhanced preparedness strategies for subsequent seasons.

Building Long-Term Monsoon Resilience

The most successful food distributors view monsoon preparedness as an ongoing competitive advantage rather than a seasonal expense. By investing in diversified sourcing, advanced forecasting, and flexible infrastructure, companies like Source International transform potential vulnerabilities into differentiation opportunities.

Resilient networks consistently outperform competitors during disruption periods, earning customer loyalty and market share that extends well beyond monsoon seasons. This long-term perspective justifies higher infrastructure investments and operational complexity in exchange for superior reliability and service quality.

Discover how Source International’s monsoon-resilient distribution network ensures uninterrupted service during peak trading periods:

-

- Explore our global sourcing capabilities: https://sourceinternational.ae/services/

-

- Read about our hub-and-spoke infrastructure: https://sourceinternational.ae/why-source-international-leads-the-uae-food-distribution-landscape-in-2025/

Ready to fortify your food distribution network against monsoon disruptions and ensure peak-season success? Contact Source International today for a comprehensive resilience assessment and customized mitigation strategy that protects your operations when weather strikes.