September 30, 2025

Middle East Export Empire Growth: UAE Distribution Companies Leading the $1.2 Billion Regional Food Trade Surge

The United Arab Emirates has long been the Gulf’s trading nexus, and in 2025 its role as a regional food export hub has never been stronger. With over $1.2 billion in intra-GCC and regional food exports recorded in the first half of the year, UAE distribution companies are orchestrating a surge in cross-border shipments of fresh produce, chilled dairy, premium meats, and specialty ingredients.

This growth reflects advanced logistics infrastructure, strategic free-zone policies, and the country’s commitment to food safety and quality standards. Leading the charge are distribution partners like Source International (sourceinternational.ae), whose regional networks and compliance expertise are enabling manufacturers and retailers to capture new markets across the Middle East and North Africa.

1. UAE’s Strategic Advantage in Regional Food Trade

1.1 Central Logistics Hubs and Free Zones

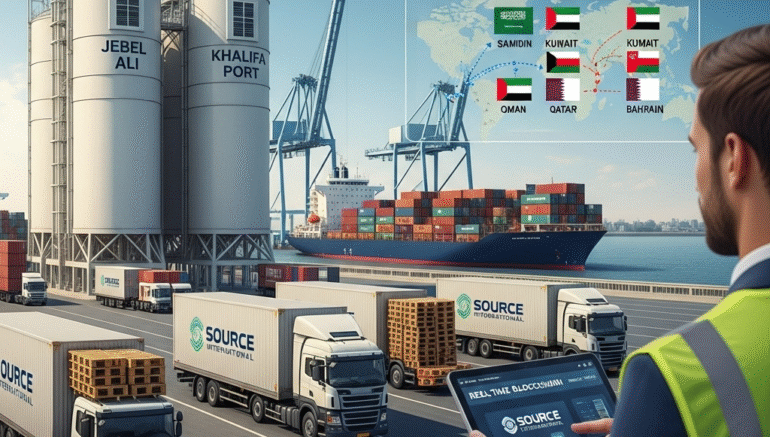

The UAE’s world-class ports—Jebel Ali in Dubai and Khalifa Port in Abu Dhabi—serve as gateways to the GCC, Levant, and North Africa. Year-to-date export volumes through Jebel Ali Free Zone have grown by 18 percent, buoyed by 24/7 operations, deep-water berths, and seamless customs clearance.

Complementing these facilities, the Abu Dhabi and Dubai food parks offer subsidized rents, streamlined licensing, and on-site cold-chain amenities.

1.2 Regulatory Alignment and Quality Standards

UAE exports benefit from harmonized regulations within the Gulf Cooperation Council, including unified food safety standards and mutual recognition of Halal, HACCP, and ISO 22000 certifications. This regulatory alignment reduces technical barriers and accelerates market entry for packaged foods, perishables, and value-added products.

2. Key Export Products Driving the $1.2 Billion Surge

2.1 Fresh Fruits and Vegetables

Exports of UAE-grown hydroponic produce—such as tomatoes, cucumbers, and leafy greens—have doubled in two years. Controlled-environment agriculture in Al Ain and Liwa ensures consistent quality and year-round supply, enabling distribution partners to ship premium fresh items to Saudi Arabia, Oman, and Bahrain within 24 hours.

2.2 Chilled and Processed Dairy

Dairy exports to Kuwait and Qatar increased by 22 percent in H1 2025, driven by demand for long-life milk, cheese, and yogurt under strict temperature-controlled conditions. Distribution companies leverage multi-temperature warehouses and specialized packaging to maintain cold chain integrity across land and sea routes.

2.3 Premium Meats and Frozen Seafoods

High-value items—such as grass-fed lamb from Australia and premium beef from New Zealand—enter the UAE and are repackaged for re-export to neighboring markets. Meanwhile, Gulf-caught seafood (shrimp, grouper) benefits from rapid processing and blast freezing facilities, securing fresh-taste profiles even after multi-day transit.

2.4 Specialty Foods and Ingredients

The UAE’s distribution ecosystem supports fine foods—olive oils, dates, spices, and confectionery—sourced globally and consolidated for regional re-export. Value-added services, including private-label packaging and quality inspections, allow brands to enter the Levant and North African markets under Gulf-branded credentials.

3. Distribution Networks Powering Regional Growth

3.1 Hub-and-Spoke Logistics Model

Leading companies operate large central hubs in Dubai and Abu Dhabi, connected to smaller spokes across the GCC. This model optimizes cargo consolidation, reduces handling times, and ensures rapid replenishment for retail chains and HORECA clients.

3.2 Multi-Modal Transport Solutions

Distribution partners combine sea freight, land transport, and air cargo to balance cost and speed. For example, time-sensitive dairy shipments move by air to Muscat and Manama, while bulk packaged goods transit via road through Al Ain to Abu T Tbilisi and Riyadh.

3.3 Customs-Bonded Warehousing

Bonded facilities in free zones allow deferred payment of duties and streamlined export processing. Export volumes stored under bond have risen by 30 percent, as companies stage large shipments ahead of seasonal demand spikes like Ramadan and Hajj.

4. Role of Source International in Driving Export Excellence

4.1 End-to-End Cold-Chain Infrastructure

Source International operates temperature-controlled hubs near Jebel Ali and Khalifa Port, featuring frozen, chilled, and ambient zones. Its integrated WMS/TMS systems synchronize shipment scheduling, real-time tracking, and customs documentation, reducing export lead times by up to 20 percent.

4.2 Compliance and Documentation Expertise

Navigating multiple regulatory regimes requires meticulous documentation. Source International’s compliance team manages Halal certificates, health attestations, and country-of-origin verifications. Clients benefit from single-window export processing that covers GCC and Levant requirements from a single point of contact.

4.3 Market Access Support

Through in-market partnerships, Source International assists brands with distributor selection, pricing strategies, and retail listing support. Its regional network extends to Bahrain, Kuwait, Oman, and Egypt, enabling faster shelf-space acquisition and localized promotional campaigns.

5. Technology Investments Enhancing Export Capabilities

5.1 Digital Traceability Platforms

Blockchain-enabled tracking provides immutable records of temperature, handling, and location for every export shipment. This transparency builds buyer confidence and expedites customs clearances across multiple jurisdictions.

5.2 Predictive Analytics for Demand Forecasting

AI-driven models analyze historical sales, seasonal trends, and port performance data to optimize export schedules. Clients leverage these insights to plan production, packaging, and shipment windows, avoiding bottlenecks and reducing inventory holding costs.

6. Overcoming Regional Trade Challenges

6.1 Geopolitical and Logistics Risks

Despite harmonized GCC frameworks, regional tensions and border controls can disrupt land routes. Distribution companies mitigate these risks by pre-positioning buffer stocks in alternative markets and securing multiple transit corridors, including sea-land combinations via the Gulf of Oman.

6.2 Infrastructure Capacity Constraints

Peak season export volumes—during Ramadan and year-end holidays—can exceed port handling capacity. Leading distributors plan around port schedules, utilize off-peak berthing slots, and coordinate with port authorities for expedited clearance windows.

7. Future Outlook: Sustaining the Export Momentum

With regional food trade expected to surpass $2 billion by 2030, UAE distribution companies must continue investing in infrastructure, technology, and international partnerships. Key focus areas include:

- Sustainable Cold Chain: Renewable energy–powered storage and electric transport fleets to reduce carbon footprints.

- Market Diversification: Expanding beyond GCC into Levant markets—Jordan, Lebanon—and North African corridors.

- Value-Added Manufacturing: In-free-zone processing and private-label facilities to capture higher margins and foster Gulf-branded products.

Source International remains at the forefront of these developments, offering scalable distribution solutions and strategic consulting for brands aiming to ride the export wave.

Conclusion

The $1.2 billion surge in UAE regional food exports underscores the nation’s emergence as the Middle East’s logistical and regulatory powerhouse. Distribution companies that combine world-class infrastructure, digital innovation, and compliance excellence will continue to lead this growth trajectory. By partnering with Source International, exporters gain access to end-to-end cold-chain capabilities, expert market support, and the agility required to navigate evolving regional dynamics.

Explore how Source International can amplify your export strategy:

- Learn about our cold-chain export services: https://sourceinternational.ae/services/

- Discover our regional market support offerings: https://sourceinternational.ae/why-source-international-leads-the-uae-food-distribution-landscape-in-2025/

Position your brand at the heart of the Middle East export boom—contact Source International today for a tailored consultation and unlock new regional markets.